PAN Aadhaar Link Status Check: A PAN (Permanent Account Number) is a unique ten-digit alphanumeric identifier issued by the Income Tax Department of India. Provided in the form of a laminated plastic card, commonly referred to as a PAN card, it functions as a unique identification number for individuals and entities in India for tax-related purposes.

PAN is essential for filing income tax returns, conducting high-value transactions, and facilitating communication between taxpayers and the Income Tax Department. It also helps in tracking and preventing tax evasion by linking all financial transactions made by an individual or entity to their PAN.

Why PAN-Aadhaar Link Is In News Again?

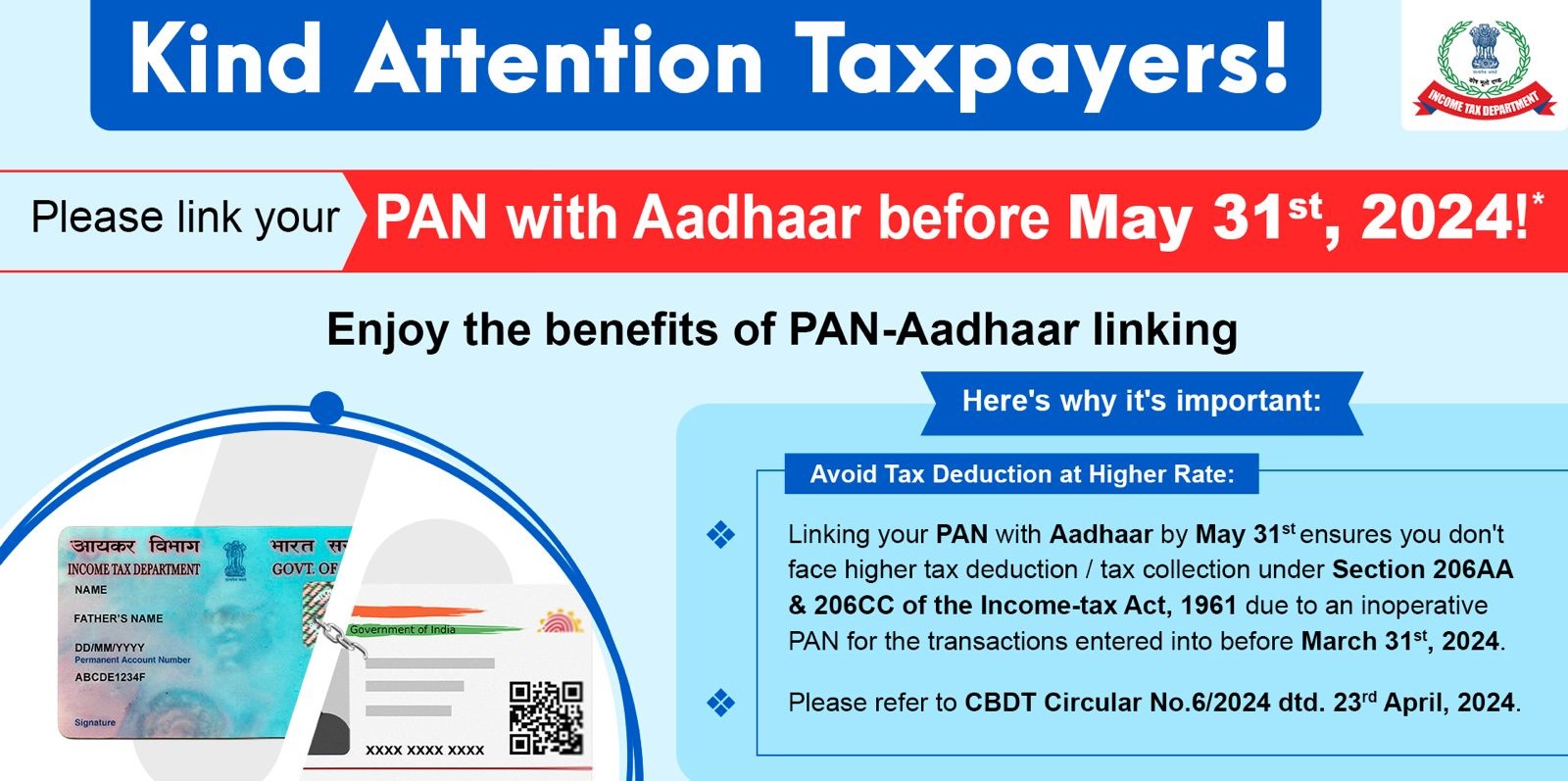

On Tuesday, the Income Tax Department issued a reminder, urging taxpayers to link their PAN with Aadhaar by May 31, 2024. In a post on X, the department warned that those who miss the deadline will face a higher rate of tax deduction at source (TDS).

“Kind attention taxpayers, please link your PAN with Aadhaar before May 31st, 2024… Linking your PAN with your Aadhaar by May 31 ensures you don’t face higher tax deduction/ tax collection under Section 206AA and 206CC of the Income Tax Act, 1961, due to an inoperative PAN for the transactions entered into before March 31, 2024,” the income tax department said in a social media post.

Linking of PAN With Aadhaar

The Finance Act of 2017 introduced Section 139AA into the Income Tax Act of 1961, mandating that every individual eligible to obtain an Aadhaar must quote their Aadhaar number when applying for a PAN or filing their income tax return, effective from July 1, 2017.

How To Check PAN Is Linked With Aadhaar Card?

Step 1: View PAN-Aadhaar link status without signing in on www.incometax.gov.in/iec/foportal/

Step 2: On the e-Filing Portal homepage, go to ‘Quick Links’ and click on Link Aadhaar Status.

Step 3: Enter your PAN and Aadhaar Number, and click on View Link Aadhaar Status.

On successful validation, a message will be displayed regarding your Link Aadhaar Status.

If the Aadhaar-Pan link is in progress, then the below message will appear on the screen;

Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on ‘Link Aadhaar Status’ link on Home Page

If the Aadhaar PAN linking is successful, then it will display the following message;

You PAN is already linked to given Aadhaar

How To View PAN-Aadhaar Link Status Post-Login

Step 1a: After login into the e-Filing Portal homepage, go to your Dashboard and click on Link Aadhaar Status.

Step 1b: Alternatively, you can go to My Profile > Link Aadhaar Status.

(If your Aadhaar is already linked, the Aadhaar number will be displayed. If Aadhaar is not linked Link Aadhaar Status is displayed)

- If the validation fails, click on Link Aadhaar on the Status page, and you will need to repeat the steps to link your PAN and Aadhaar.

- If your request to link PAN and Aadhaar is pending with UIDAI for validation, you will need to check the status later.

You may need to contact the Jurisdictional Assessing Officer to delink Aadhaar and PAN if:

- Your Aadhaar is linked with some other PAN

- Your PAN is linked with some other Aadhaar